avoiding the TurboTax trap + how to actually file for free

TurboTax tends to be used synonymously as a free way to file your returns when you don’t use a professional. The marketing for TurboTax is so good, that we’ve all believed for years that its any easy and FREE way to file your taxes. We’ve heard people talk about how they like how the refund numbers in the corner go up and down and its like a fun game.

It turns out there are several lawsuits and TurboTax is rarely free. Here are some facts about how TurboTax makes their money AND had legally created a monopoly with the IRS. Because as per usual, the system is very much involved.

What’s the love story between TurboTax and the IRS?

In 2003 the Bush administration proposed the IRS make a free tax filing program - obviously companies like Intuit (owner of TurboTax) lobbied against this because how else could they make money? The end agreement was that TurboTax and similar software companies would offer a free version and then the IRS would not develop its own portal.

Eventually in 2019 Intuit (TurboTax) left the Free File Alliance because the rules that the government placed around their product were “too restricting”. In other words, it was harder to get paid.

So how did the free file system work for TurboTax?

The strategy that TurboTax used was to bring all American taxpayers into their software by promoting it was free - in addition it was listed on the IRS website as a place to file for free. So they convinced the IRS that they will take care of free filing for Americans, and then they used it as a marketing tool to drive everyone to their paid products with their blessing.

As with most billion dollar companies, their marketing tactics were misleading and predatory to users who intended and are entitled to file for free.

How did this affect us? (we say us because US taxpayers is all of us!)

Per an audit by the Treasury Inspector General for Tax Administration in 2019 there was an estimated 14MIL taxpayers that PAID for a TurboTax product that they could have received for free. This generated $1 billion in revenue for TurboTax and similar companies.

Per the audit in 2019, only 2.4% of those eligible to file for free actually did.

Who should use the Free File system?

Coming from the experience of preparing hundreds of tax returns for money, filing for free should always be an option for the right taxpayers.

There are always exceptions and from the standpoint that everyone has different emotions and feelings when it comes to taxes. For some, tax can equal trauma. And if you’d rather pay someone a fee for peace of mind, please do. And also use our directory to do so!

Free file is for those making under $73,000/year.

Here are some examples of good candidates under that income threshold:

W2 only earners (no self employment) - you don’t need us to enter 5 numbers for you

You’re retired - collecting 1099R forms and social security payments

You’re unemployed - collecting unemployment or not

Uber/Lyft/Dash/etc. drivers - great example of a small gig where you simply enter income, miles and potentially minimal supplies

Small gig worker - with truly close to no expenses

How to file for free!

Go to the Free File site by the IRS here

Under Browse All Providers, select “Browse All”

BEFORE YOU CREATE AN ACCOUNT, MAKE SURE that you

Clicked through from the IRS.gov Free File page to that company’s website, and

Signed up on that specific landing page you reach. Otherwise you may accidentally create a “paid product” account.

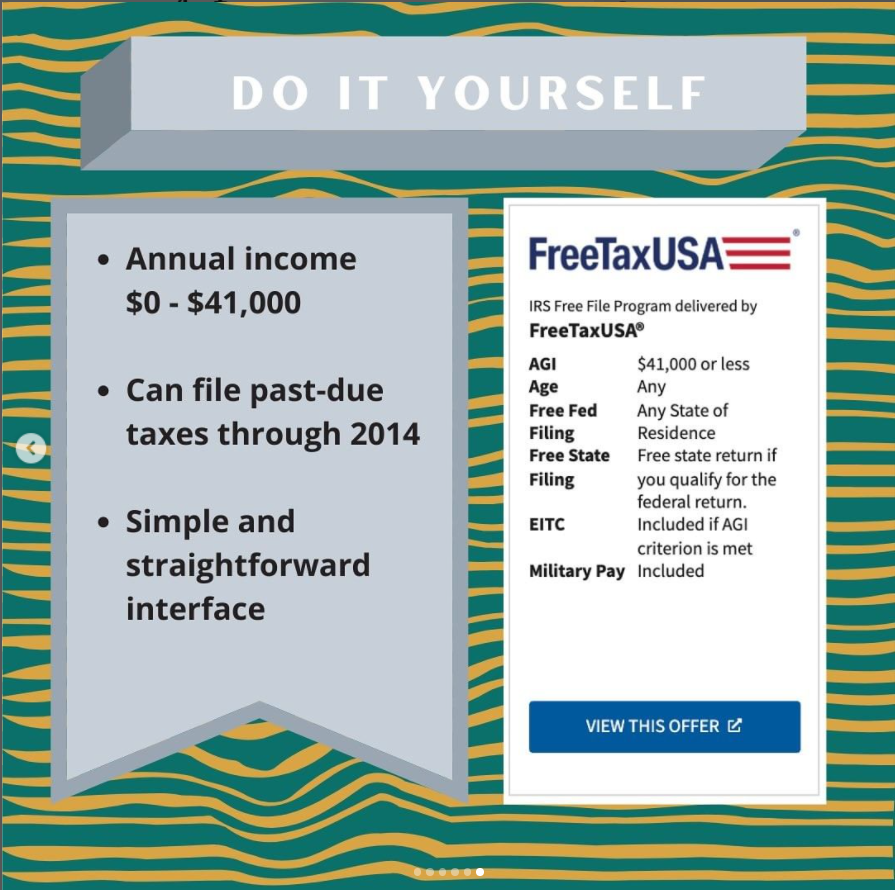

Here are some more details on a couple of the options:

image from @tax_clown

image from @tax_clown

FAQs

Who should use a tax professional?

First of all, anyone that is willing to pay the fee to get the job done right. Some folx have severe anxiety of the IRS and the fee to pay a professional is well worth the peace and assurance.

Secondly, anyone who has multiple streams of income that are either through rentals, self employment, or nontraditional investments (like crypto). It will cost you to file these incorrectly - whenever investing just think of tax prep as a necessary expense. We are able to save you money at times and strategize, but at the end of the day our job is to get it RIGHT.

Lastly, if you make over and beyond the threshold of free file - its possible a cheaper software still makes sense, but you’d be surprised the comparative cost to be able to work with an actual human who can just take all of it off your hands.

What about the child tax credit this year?

Yes, its quite the curveball this year and we don’t want you to miss out on accidentally entering the wrong thing and not getting what you deserve. You can still do the Free File option, but unique to 2021 tax year you’ll need confirmation of what you received in advanced child tax credits. You can easily get that here.

What if I don’t have a filing requirement but I want my stimulus or child tax credits?

You’ll still need to file - in this case we highly recommend the free file options. If you are missing info for the stimulus payment history you can get that here.

Turbo Tax charged me in the past for a free file return, am I owed anything?

Yes! You can actually get that refunded to you thanks to the Probuplica.

What about multiple states? Is it still free?

It depends on the software you’ll use. FreeTaxUSA says they allow unlimited state returns as long as you qualify for Free File. OLT software currently allows at least 3 state returns for free.

Want to thank us?!

Accountants of Color would love to have your support as we continue to educate, provide scholarships and give free resources to the public like our directory. All of this costs money and we make sure to circulate it in our BIPOC community. Thank you for your donations and sharing our directory.

Blog Author: @kelliloocpa

Free File Resources Guide: @tax_clown